|

Getting your Trinity Audio player ready... |

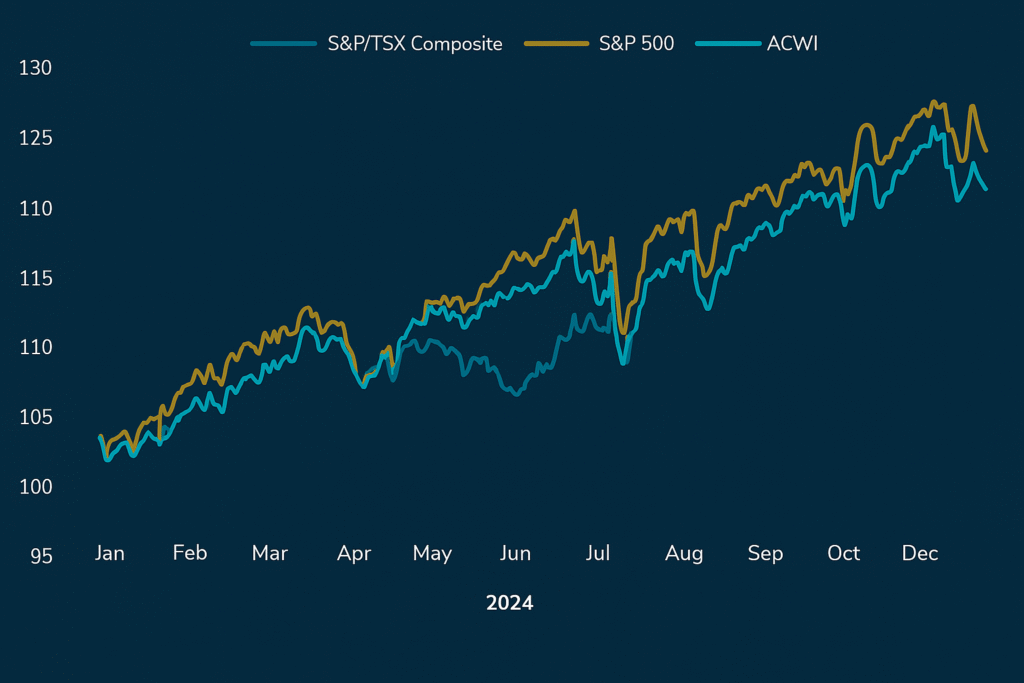

The Stock Market Forecast 2025 is the center of attention as Wall Street continues to ride a wave of optimism, yet caution clouds the horizon. With the S&P 500 breaking record highs and the Nasdaq thriving on AI-driven momentum, many investors are asking a critical question: Will the stock market crash in 2025, or are we witnessing a new era of sustainable growth?

A Bull Market Fueled by Hope But For How Long?

Over the past six months, the US stock market has seen unprecedented gains. Leading sectors such as technology, green energy, and defense have outperformed expectations. The S&P 500 outlook 2025 remains strong currently hovering above 5,400 points driven by earnings strength, consumer spending resilience, and investor optimism over potential Federal Reserve rate cuts later this year.

But despite the bullish trend, economic analysts are signaling a need for vigilance.

“Markets are pricing in a soft landing, but inflation data, Fed decisions, and global instability can quickly turn sentiment,” warns Angela Lopez, Chief Market Strategist at Monroe Capital.

This mirrors many stock market predictions 2025, which remain split between aggressive growth forecasts and conservative warnings of a mild to moderate correction.

What’s Driving the Market in 2025?

Several factors are shaping the current stock market trends 2025:

- Federal Reserve policy remains pivotal. While inflation has cooled, it still lingers above the 2% target, delaying definitive action from the Fed.

- Earnings season in Q2 has so far beaten estimates, particularly in the tech and consumer goods sectors.

- Geopolitical risks, including tensions in Eastern Europe and Asia, continue to impact investor confidence globally.

Tech and AI Lead the Charge: Stock Market Forecast 2025

The future of Wall Street is increasingly being shaped by disruptive technologies. Stocks tied to artificial intelligence, cybersecurity, and cloud infrastructure are leading the way, drawing billions in institutional capital.

Nvidia, Alphabet, and Amazon Web Services remain top picks among investment firms, driven by explosive demand for AI tools across industries.

“AI is not a bubble—it’s an ecosystem. Investors who ignore it risk missing the backbone of future economic growth,” says Derek Chen, Head of Equities at EastBridge Financial.

Should You Worry About a Crash?

The question “Will stock market crash 2025?” is trending online—and not without reason. Some market veterans point to overvalued sectors, an overheated rally, and speculative behavior reminiscent of pre-2000 conditions.

Yet most forecasts suggest that any correction would likely be short-term and sector-specific, rather than a full-blown collapse.

Stock Investment Tips 2025: How to Navigate This Market

With both opportunity and risk in the air, here are key stock investment tips for 2025:

- Diversify across sectors – balance growth stocks with defensive assets.

- Monitor Fed announcements – interest rate guidance will drive market direction.

- Avoid speculative hype – focus on fundamentals and long-term value.

- Stay informed – track major economic indicators and earnings results.

Adaptability Is the Key to Growth

The Stock Market Forecast 2025 shows signs of strength, innovation, and resilience. But investors must remain adaptable. With macroeconomic shifts, evolving technologies, and policy pivots shaping the future of Wall Street, success in 2025 will belong to those who think long-term and move with insight not panic.

Stay tuned to Next Tech Plus for the latest US stock market news, investment updates, and expert analysis on where the markets are heading next.