|

Getting your Trinity Audio player ready... |

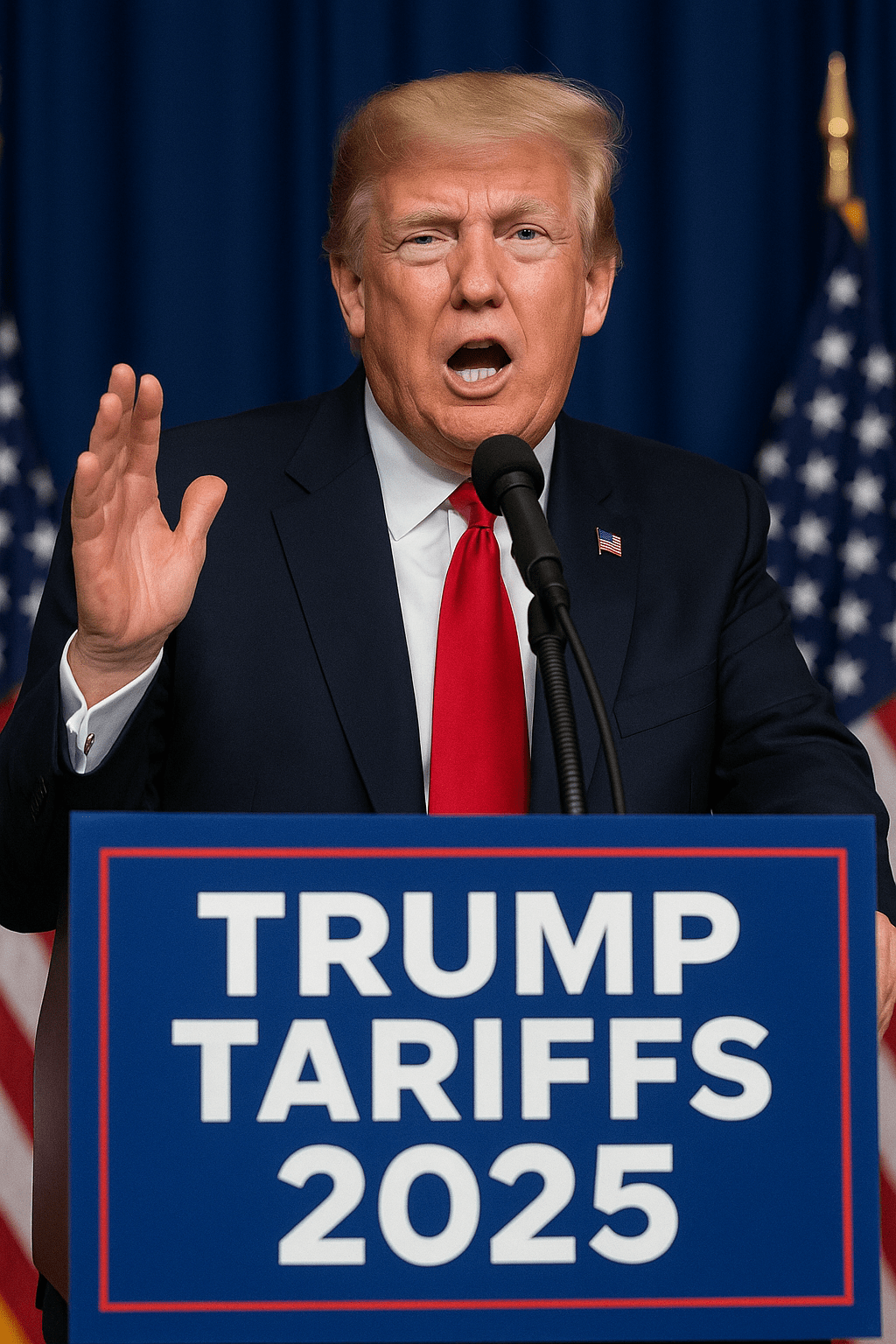

In a stunning announcement that is already rattling international markets and diplomatic circles, former President Donald Trump unveiled sweeping new tariffs targeting 68 countries, marking a dramatic escalation in U.S. trade policy. The Trump new tariffs 2025 policy is not just a political maneuver it’s a full-scale economic offensive that could redefine how America trades, manufactures, and competes globally.

These tariffs, which will go into effect on August 7, 2025, reflect Trump’s revived “America First” agenda and a sharpened focus on reducing U.S. dependence on foreign imports. This move is seen by many as the most aggressive trade action since his first administration.

68 Countries Face Tariff Hike Under Trump’s New Economic Strategy

The Trump new tariffs 2025 directly target 68 countries, including major U.S. trading partners such as India, the European Union (Germany, France, Italy), Brazil, Mexico, South Korea, Vietnam, and Turkey. Tariff rates reach as high as 41% on certain goods especially in critical sectors like automobiles, electronics, steel, textiles, pharmaceuticals, and agriculture.

Here’s a breakdown of the most affected regions:

- India: 25% tariffs across multiple industrial goods

- European Union: 35–41% on cars, machinery, and pharmaceuticals

- Brazil and Mexico: 20–30% on agricultural and auto exports

- Southeast Asia and Latin America: Across-the-board 10–25% tariffs

Trump made it clear: “The days of the U.S. being ripped off are over. These tariffs will rebuild our factories, bring jobs back, and stop foreign exploitation.”

Trump New Tariffs 2025: What This Means for the U.S. Economy

Supporters of the Trump new tariffs 2025 claim that this strategy could jumpstart American manufacturing, reduce the trade deficit, and reassert U.S. industrial power. The U.S. economy under Trump is being reshaped with nationalistic goals at the forefront.

However, many economists caution that while certain industries may benefit short-term, consumers could face higher prices. The impact of Trump tariffs could include:

- A surge in costs for imported goods, especially electronics and vehicles

- Inflation pressure on household essentials

- Possible job gains in manufacturing, but losses in retail, tech, and agriculture

The U.S. Chamber of Commerce warned: “Tariffs are taxes. While the intent is to protect American jobs, the reality could be reduced competitiveness and global backlash.”

Financial analysts at Goldman Sachs predict a 0.5% decline in U.S. GDP growth over the next year if retaliatory tariffs emerge an increasingly likely scenario given the global trade tension 2025 is already mounting.

Global Reaction: Allies Respond to Trump’s Trade War 2025

World leaders and trade organizations are reacting swiftly and forcefully. The European Commission called the tariffs a “direct violation of WTO norms”, and hinted at countermeasures on U.S. tech and agricultural exports. India’s Commerce Ministry described the move as “protectionist and politically motivated,” with immediate talks of retaliatory tariffs.

This is fast turning into the Trump trade war 2025 a battle of global economic wills that could isolate the U.S. or strengthen its leverage, depending on how the administration navigates diplomatic fallout.

Countries affected are not limited to economic rivals many are long-time U.S. allies, making the backlash more complicated. South Korea, for instance, said it would “review all military and trade partnerships” if the tariffs proceed.

Political Timing and Trump’s Campaign Strategy

The Trump economic policy 2025 isn’t just about numbers it’s a campaign weapon. With the 2024 presidential race heating up, Trump is positioning himself as the only candidate tough enough to “stand up to global freeloaders.” His message has found strong support among industrial states like Michigan, Ohio, and Pennsylvania, where voters see these tariffs as a long-overdue defense of American workers.

Trump declared:

“This is our national survival, not just an economic issue. These globalist deals cost us factories, futures, and freedom. I’m bringing that back.”

The tariffs’ timing, which comes just months before the general election, suggests a deliberate plan to control the news, undermine Biden’s more tactful approach to trade, and mobilize support from the working class and conservatives.

Market Response and What’s Next

Wall Street responded with volatility. The news caused the Dow Jones Industrial Average to drop 1.2%, while U.S. steel, manufacturing, and auto sectors surged. Agricultural and tech stocks dropped amid fears of foreign retaliation and higher production costs.

Already, multinational corporations are rushing to reevaluate their supply chains. Retailers warn that back-to-school and holiday prices could spike, placing more burden on middle-class families.

Meanwhile, quiet emergency talks are reportedly underway between the Biden administration, the EU, and India, aiming to de-escalate what many fear could become a full-blown global trade war 2025.

A Turning Point for Global Trade?

The Trump new tariffs 2025 are more than a policy shift they represent a philosophical shift in how America views its role in the global economy. While supporters praise it as a bold step toward economic sovereignty, critics argue it risks igniting global conflict and harming consumers.