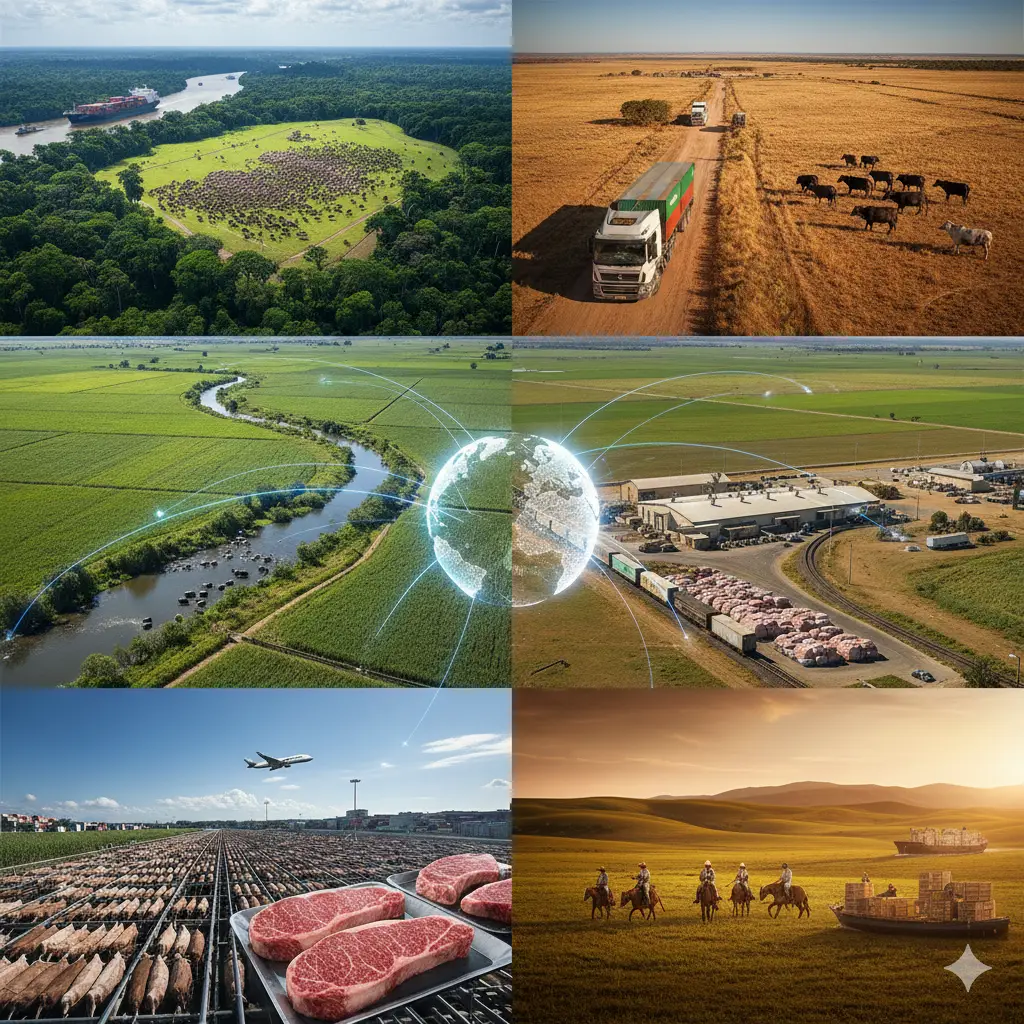

The global beef market is undergoing a seismic shift in 2025. While consumer demand remains high, trade patterns are being redrawn by changing environmental policies, fluctuating herd sizes in North America, and the rise of emerging markets in Asia and the Middle East.

For businesses and consumers alike, knowing where your beef comes from is more important than ever. Here is a breakdown of the leading nations dominating the global beef export market this year.

1. Brazil: The Undisputed King of Beef

Brazil remains the world’s largest exporter of beef in 2025, projected to ship approximately 3.75 million metric tons.

- Competitive Edge: Low production costs and a massive land base for cattle grazing allow Brazil to offer highly competitive pricing.

- Key Markets: China remains Brazil’s top buyer, though the country has successfully diversified its exports into the Middle East and North Africa (MENA) and North America.

- 2025 Trend: Despite new environmental regulations, Brazilian exporters like JBS and Marfrig continue to scale through advanced logistics and vertical integration.

2. Australia: The Premium Powerhouse

Australia has reclaimed a strong second position in 2025, capitalizing on the “liquidation phase” of its cattle cycle, which has led to record-breaking production volumes.

- Competitive Edge: Australia is synonymous with “Clean and Green” beef. Its high standards for biosecurity and animal welfare make it the preferred supplier for premium markets.

- Key Markets: Japan, South Korea, and a surging demand from the United States (to fill the gap in domestic U.S. production).

- 2025 Trend: Australian beef production is expected to hit a record 2.55 million tonnes this year, supported by favorable exchange rates.

3. India: The Global Leader in Carabeef

India holds a unique spot in the global rankings. Its exports consist primarily of carabeef (water buffalo meat), which is highly valued for being lean and cost-effective.

- Competitive Edge: India offers the world’s most affordable bovine protein, which is essential for food security in developing regions.

- Key Markets: Vietnam, Malaysia, Egypt, and Saudi Arabia.

- 2025 Trend: Indian meat exports have surged over 5% this year, with a focus on upgrading halal-certified slaughterhouses to meet the strict standards of the Gulf nations.

4. The United States: High-Value Specialist

While the U.S. is the world’s top producer and consumer of beef, it ranks fourth in exports for 2025. This is largely due to a 50-year low in the domestic cattle herd.

- Competitive Edge: The U.S. specializes in high-value, grain-fed cuts. While they export less volume than Brazil, the value per pound is significantly higher.

- Key Markets: Mexico and South Korea remain top destinations for American corn-fed beef.

- 2025 Trend: The U.S. is currently a “net importer,” buying lean grass-fed beef from Australia and Brazil for ground beef while exporting premium steaks abroad.

5. Argentina: The Tradition of Excellence

Rounding out the top five is Argentina. Despite economic volatility and recent droughts affecting production costs, “Argentine Beef” remains one of the world’s most powerful food brands.

- Competitive Edge: A global reputation for taste and texture. Argentine grass-fed beef is a staple in European steakhouses.

- Key Markets: The European Union and China.

- 2025 Trend: While production is projected to dip slightly (approx. 9%), Argentina is pivoting toward high-margin, chilled boneless cuts rather than bulk frozen exports.

2025 Global Export Statistics at a Glance

| Country | Est. Export Volume (2025) | Primary Product Type |

| Brazil | 3.75 Million MT | Frozen/Grass-fed |

| Australia | 1.69 Million MT | Chilled/Premium Grass-fed |

| India | 1.60 Million MT | Frozen Carabeef (Halal) |

| USA | 1.20 Million MT | Grain-fed/High-value cuts |

| Argentina | 0.81 Million MT | Grass-fed/Boutique cuts |