New York: U.S. semiconductor stocks opened the week with mixed movement as investors assessed global demand signals and supply chain developments. Nvidia, AMD, and Intel showed varied performance in early trading while analysts continued to monitor the broader semiconductor cycle.

Nvidia began the week with moderate gains. Traders cited ongoing demand for data center hardware and AI accelerators as the primary drivers. Market analysts noted that enterprise orders remain stable, although supply constraints in advanced lithography are still under review.

AMD traded relatively flat in the opening session. Investors evaluated the company’s position in the CPU and GPU markets amid competition in both consumer and enterprise segments. Analysts said upcoming product announcements could influence short term momentum.

ALSO READ – Your Ultimate Guide to an Incredible USA Trip in 2025: Essential Tips & Smart Travel Hacks

Intel showed slight declines following discussions about potential delays in advanced node manufacturing. The company continues to expand its foundry strategy, but investors remain cautious about near term revenue projections. Several research firms said they are tracking updates from Intel’s supply partners.

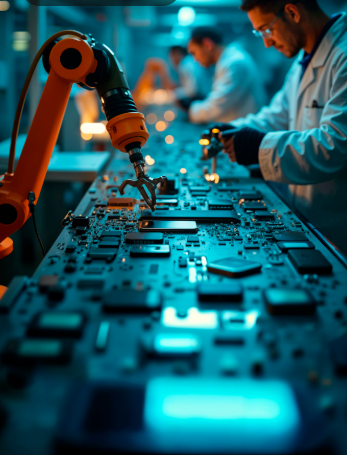

The U.S. semiconductor index showed modest volatility across the morning session. Market observers attributed the movement to shifting expectations around global demand, especially from enterprise cloud providers and AI hardware buyers. Analysts added that geopolitical conditions may influence component pricing in the coming weeks.

Traders are watching export control updates, memory chip pricing trends, and the status of major production facilities in Asia. Market activity is expected to remain sensitive to new economic data and quarterly earnings reports scheduled for later this month.